The terms telehealth and telemedicine mean very different things to medical professionals, although we’re sometimes tempted to use them interchangeably. When you and your doctor aren’t in the same room, but your doctor gives you medical care, that’s telemedicine. When you’re using tools to communicate with your doctor or manage your health, that’s telemedicine. (Learn more)

Here’s what you need to know about these new technologies:

- They’re used to treat many conditions. Colds, coughs, and other nonurgent health conditions benefit from this approach. Emergency room visits also include telemedicine approaches. But other health issues, such as diabetes and depression, could be addressed through telemedicine or telehealth. (Learn more)

- In some parts of the country, they’re critical. For some of us, the idea of skipping an office visit is the main benefit of telemedicine and telehealth. But for some communities, these services are crucial. Doctor shortages, including a lack of specialists, are common in some parts of the country. The only way to get care is through a digital solution. (Learn more)

- While they’re widespread, they’re not available everywhere. Many health insurance companies, including Kaiser Permanente and Anthem, offer telemedicine options to their clients. (Learn more) But legislative issues and payment issues block their widespread use. If you live in some parts of the country, they may not be available to you.

- They may not save you money. Telemedicine and telehealth are designed to cut costs, but insurance companies may not share that benefit with you. (Learn more)

- You’ll need to contact your health insurance company to find out more. Whether you can access telemedicine or telehealth, and how much you’ll pay for these solutions, varies widely. Your insurance company can tell you more. (Learn more)

Telemedicine and Telehealth: What’s the Difference?

The internet has changed almost everything about our lives. We can hear about events happening across the world in seconds rather than weeks. We can write notes to the people we love and read their responses instantly rather than waiting for the mail. Telemedicine and telehealth aim to bring that immediacy and proximity to the world of medicine.

The term telehealth, according to the New England Journal of Medicine, is a blanket term that covers everything about telecommunications and health. You might use this term when talking about:

- Health education. Your doctor pops videos into a portal to tell you more about how to treat or manage a medical problem.

- Wearables. You wear a fitness tracker or heart monitor, and the data is streamed to your medical team.

- Consults. Your doctor talks to another specialist about your health and what should happen next.

- Critical communication. Your health insurer sends a text message about a disease outbreak in your area.

- Appointment streamlining. Your doctor sends a questionnaire before your visit, and you answer questions about your symptoms, your lifestyle, and your health online rather than doing that work in the waiting room.

The term telemedicine is a very specific term that refers to a virtual visit with your doctor. You’re connected via video chat or some other form of technology, and you work together to deal with a health problem. It’s very similar to a traditional office visit, but you’re not in the same room.

A telemedicine visit is technically part of a group of telehealth services, so these terms do have a lot of overlap.

What Conditions Benefit?

All of us deal with medical problems from time to time. While some absolutely require the in-person help of a medical professional, there are plenty of opportunities for digital solutions. In fact, even complex cases benefit from an injection of virtual assistance.

When doctors talk about the benefits of telehealth, they refer to:

- Nonurgent health care. Coughs, colds, urinary tract infections, and ear pain cause misery, but they’re relatively easy to treat. Your doctor could deal with the issue in a telemedicine appointment, or you could watch online videos about how to care for the problem at home.

- Diabetes. As Mayo Clinic points out, people with diabetes often need multiple types of care. You might upload your blood sugar readings, watch videos on eating right, use apps to estimate your insulin dose, talk online with your doctor about test results, and more. All of these telehealth solutions help you to control this chronic condition, and they could help cut down on the number of in-person appointments you need.

- Emergency medicine. Imagine you’ve had a serious, baffling health problem that brought you to the ER, and the doctor there isn’t sure what’s wrong. A telemedicine conversation with a specialist could deliver the right diagnosis and treatment plan so you can heal quickly.

- Mental health. The American Hospital Association says cuts of $5 billion in mental health services between 2009 and 2012 mean more people with psychiatric problems come to emergency rooms for care. Telemedicine visits could help people connect with a mental health specialist right away, and they can maintain that connection after discharge, so they can keep their condition under control.

These are just a few examples of how professionals hope to use digital tools to keep patients both healthy and comfortable even if they never step foot in a doctor’s office.

Why Do We Need These Solutions?

We all want to skip a visit to the doctor’s office. Each appointment takes time out of our busy schedule, and while we wait, we’re surrounded by coughing, sneezing, and other germ-laden activities. Staying home could save us both time and illness. But in some parts of the country, telehealth does more than spare us irritation. It could be critical.

Research from the Association of American Medical Colleges suggests that we could see shortages of up to 120,000 doctors by 2030. Fewer people are enrolling in medical care, researchers say, and more people need help from trained professionals.

Primary care shortages are especially worrisome, as we use these doctors to help us move through the health care system. These doctors:

- Treat routine illnesses (like strep throat and ear infections).

- Perform cancer screenings.

- Give us vaccines.

- Set up appointments with specialists.

If there aren’t enough of these doctors, we lose the ability to start a health care conversation.

But it’s not just primary care doctors that are in short supply. Experts say we also don’t have enough specialists, and that could be a big problem as the population ages.

Merritt Hawkins explains that seniors make up only 14 percent of the population, but they’re responsible for 34 percent of inpatient medical care. Since about 10,000 baby boomers turn 65 each day, more specialists are required to keep them healthy.

Rural areas are also hit hard by specialist shortages. Stat points out that most specialists work in large medical centers, where they can see a lot of patients in one day. But those centers are located in urban areas, and some rural residents don’t have a way to get to the big clinics for help.

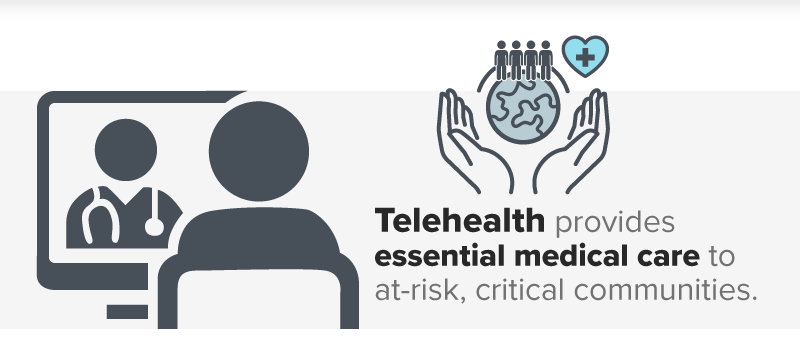

Experts hope that telehealth will:

- Reduce inefficiencies. Your doctor wastes time on in-person visits too. If medical professionals can sit at their desks and help 20 patients per day (rather than 10), that could help them reach more people despite shortages.

- Make health care fair. Everyone should have access to help, no matter where they live. Telehealth could make that dream a reality.

- Improve specialty care. Virtual visits could connect you with the right professional in minutes, with no long trip required.

- Encourage preventive care. Health problems are easier to solve when they’re caught early. Quick, easy, digital appointments could connect you with the screenings and tests you need, so a problem doesn’t worsen.

How Do Health Insurers Use These Solutions?

People who believe in telemedicine think every patient should have access. The benefits are huge, they say, and there’s no reason not to take advantage. Many health insurers seem to agree.

Insurance companies that offer telehealth include:

- Kaiser Permanente. The insurer provides telemedicine appointments, and according to researchers, 93 percent of patients who use these digital visits like them. Most appointments last about 8.2 minutes, and the majority of them are conducted via smartphone. Even so, less than 1 percent of all office visits happen this way, researchers say. They’re not sure why more people don’t use this model if it’s so efficient and people like it so much.

- Anthem. In telemedicine appointments, patients can talk about colds, pain, allergies, infections, and other routine issues. Patients can even get prescriptions with this service, the company says.

- Cigna. Board-certified doctors are available via video or phone for members, and there are two types of doctor systems to choose from. Cigna suggests that this is a good option for people with an urgent issue who can’t get to their doctors for care.

Most of these companies also offer telehealth options. They encourage their clients to sign up for online portals to make appointments, review test results, get educational materials, and sign up for wellness benefits. The sophistication of each solution set varies, depending on the company and the plan, but most provide their clients with at least some telehealth component in addition to telemedicine options.

Government-sponsored health care, including Medicare and Medicaid, is a little different. As the National Conference of State Legislatures explains, Medicaid plans are administered by the state, and each state has different rules about how doctors are paid and how plans are administered. Medicare plans are complicated, as some add-on plans are handled by private companies, and they may or may not include telehealth services.

Licensing Blocks Widespread Use

Medicine is sensitive, and doctors must go through years of training before they can care for patients. Doctors must also have licenses to practice in the states in which their patients live. This rule can make widespread adoption of telemedicine difficult.

Some private companies offer telemedicine services to health insurance companies. When patients want medical advice, they call a special number or pull up an online portal, and they talk to doctors who are thousands of miles away.

In some states, those remote doctors can’t diagnose disease, write prescriptions, or order tests without a valid, in-state license. That means some doctors can’t do their work.

Advocates of telehealth say they’re pushing for federal licensure, so doctors can practice medicine anywhere across the country. They’re also looking for regional licensing opportunities, so doctors could cross a few (but not all) boundary lines. These solutions may be applied soon, but they’re not in place quite yet.

How Much Will You Pay?

If you do have access to telehealth, you might think that your medical bills will drop. While that’s possible with some health insurance companies, it’s not widespread.

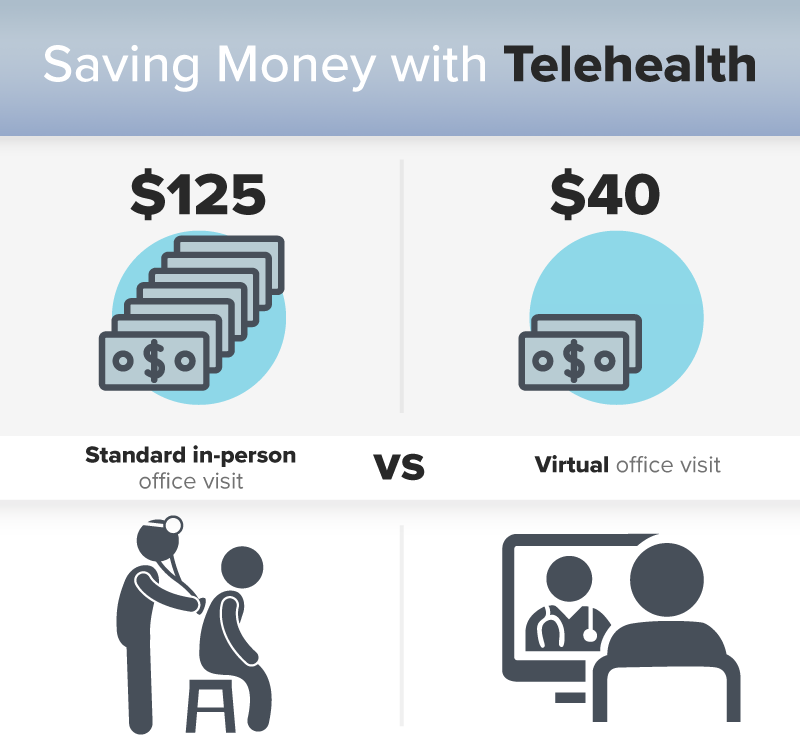

As Kaiser Permanente points out, telehealth appointments can save health insurance companies money. A standard, in-person office visit costs about $125, while a virtual one comes with a $40 price tag.

But health insurance companies have a lot of leeway when it comes to passing savings on to customers. They might choose to charge less for a virtual appointment, or they might keep the prices the same. They’re not required to ensure you save money just because they do.

How much you might pay for telehealth services depends on your insurance company and your plan. These examples make the differences plain:

- Kaiser Permanente: Your telemedicine appointment comes with the same fee attached to an in-person appointment. If you must pay a deductible for care, you’ll have to follow those same rules with a digital visit.

- Anthem: You’ll pay $49 per telemedicine appointment, but you will have to follow rules about deductible and coinsurance payments.

- Cigna: You’ll pay the same fees associated with an in-person visit. The company says you might pay less but doesn’t specify how much you’ll be charged. You must register for the service before you can use it.

After you’ve covered the cost of your appointment, you may have other bills to pay. People who advocate for telehealth often say that these visits replace your need for an in-person visit. But researchers say this isn’t quite true.

Research from Kaiser Health News suggests that just 12 percent of telemedicine visits eliminate the need for an in-person appointment. Most of the time, researchers say, people who use this care have a new problem they’re not sure how to handle. They may need more tests, a specialist appointment, medication monitoring, and more to get well. Each one of those additional issues requires another visit, and all of those visits come with fees.

You might save a bit of money on the initial appointment by accessing telemedicine, but it’s critical to remember that other bills and fees could come your way, depending on the diagnosis.

It’s also vital to remember that some telehealth services happen in the hospital. For example, if you’re very ill and your doctor isn’t sure what should happen next, a conversation with a specialist could help. These telemedicine visits don’t involve your voice, but you could get billed for them.

Providence Health and Services, for example, offers telemedicine stroke services help to doctors in Oregon and southwestern Washington. Rural doctors can sign up for the service, and they can call Providence when they need advice on treating a patient. Providence reports that these doctors can pass fees along to their clients if that’s something they’d like to do.

If you’re in the hospital and your doctor uses these types of solutions, you might see them on your bills, and the price for that care can vary widely.

Does Your Plan Cover Telehealth?

Most health insurance companies are intrigued at the idea of saving money, and if they have telehealth services, you probably know about it.

Your health insurance company might encourage you to:

- Create an online profile to manage appointments, test results, and health education.

- Follow them online to read more about managing your health.

- Take home free wearables, like Fitbits and pedometers.

- Sign up for telemedicine services so you can get care on the go.

These aren’t just marketing ploys to make you feel good about your insurance coverage. They’re savvy pleas to help you take advantage of digital solutions to cut costs and improve access to care.

But if you’d like to join this digital revolution and you’re not sure it’s covered, you should call your insurance company to find out. Find your identification card, and look for the member services phone number listed on the back. Call and ask about the digital solutions available to you, and ask about the fees associated with each type of care.

If you’d like, ask the company to send you written materials about what’s available and how much it costs. Keep that paperwork handy, so you’ll know exactly what to do to take part.

If you’re in the hospital, ask your doctor about telemedicine consults. If your doctor plans to use outside help, ask to speak to the business office before that appointment. A quick conversation between you and billing can help you understand if those fees will appear on your bill and how big they might be. The hospital won’t mind answering your questions.

Managing benefits and asking about money can be a little uncomfortable, especially if you tend to steer clear of financial conversations. But with a little planning, you can make sure you’re making the most of the coverage you’ve purchased.

References

What Is Telehealth? (February 2018). NEJM Catalyst.

Telemedicine and Telehealth. (September 2017). HealthIT.gov.

Telehealth: Technology Meets Health Care. (August 2017). Mayo Clinic.

Telehealth: Helping Hospitals Deliver Cost-Effective Care. (April 2016). American Hospital Association.

New Research Shows Increasing Physician Shortages in Both Primary and Specialty Care. (April 2018). Association of American Medical Colleges.

Physician Supply Considerations: The Emerging Shortage of Medical Specialists. (2018). Merritt Hawkins.

Although We’re Running Low on Doctors, the Solution May Not Be More Doctors. (September 2018). Stat.

Kaiser Permanente Sees Good Results With Video-Based Telehealth. (October 2018). mHealth Intelligence.

Anthem Offers Members 24×7 Access to LiveHealth Online Telehealth Benefit. (August 2014). Anthem.

Cigna Telehealth Connection Program. Cigna.

State Coverage for Telehealth Services. (January 2016). National Conference of State Legislatures.

Designing the Consumer-Centered Telehealth and eVisit Experience. EngagedIN.

The Rise of Telemedicine and Lower Costs. Kaiser Permanente.

KP Now Telemedicine Appointment. Kaiser Permanente.

LiveHealth Online. (July 2014). Anthem.

Cigna Telehealth Connection Program. Cigna.

Are Virtual Doctor Visits Really Cost Effective? Not So Much, Study Says. (March 2017). Kaiser Health News.

Telemedicine FAQs. Providence Health and Services.