Table of Contents

Insurance Terms

Finding Insurance

Finding a Doctor

Vaccines

Health Screenings

Fees

Saving Money

In many countries, health care coverage isn’t a luxury. It’s a right.

In Mexico, for example, Seguro Popular offers even impoverished citizens access to preventive care, including vaccines and health care screenings. You also have coverage for catastrophic illness.

The United States is a little different.

We don’t offer universal coverage to all citizens in the United States. That means moving here means becoming a savvy health care consumer. You can start by learning the lingo doctors and health care companies use to describe the work they do. (Learn more)

You’ll use that terminology to help you:

- Find a health insurance policy that’s right for you. (Learn more)

- Connect with a doctor who manages your care. (Learn more)

- Get vaccines you need to prevent disease. (Learn more)

- Access health screenings to prevent some illnesses. (Learn more)

Sometimes, the care you access comes with a bill. (Learn more) But you can use your insurance plan to help you save money on medical care. (Learn more)

Insurance Terms to Know

Health insurance is complicated. Technical terms distill key concepts into a few phrases, so your paperwork is shorter. In time, you can learn to understand what’s said or written about your health insurance.

But don’t be embarrassed if it doesn’t make sense right now. Most Americans who grew up in the system have questions. For example,

With a little study, you could be different.

These are the top terms you should understand right now, as you enter the American Health Care system:

- Deductible: The yearly amount you pay before your insurance company starts paying. Some plans don’t come with deductibles. Others do.

- Coinsurance: You’ve paid your deductible in full, and your insurance starts paying. Sometimes, you have to chip in a little too. That fee is your coinsurance payment.

- Explanation of benefits: How much did a visit cost? How much did the company pay, and what’s left on your bill? All of that data is in an explanation of benefits, or EOB.

- Health savings account (HSA): Think of this as a special savings account made just for your health care expenses. You put money in before your salary is assessed for taxes.

- Out-of-pocket maximum: This number represents the highest fee you’ll pay in a year for coinsurance, deductibles, and other expenses.

- Premium: This is your fee for insurance. You must pay it to keep your plan active, and it doesn’t apply toward your deductible or your out-of-pocket maximum.

- Network: Some health insurance companies make agreements with doctors, hospitals, and clinics. The insurance company will send patients there, and the health care providers will charge less. Everyone who agreed to this plan is in a network. If you choose someone else, you might have a bigger bill.

- Primary care provider (PCP): Think of this person as a gatekeeper. You see this person first before you get any kind of medical care.

- Health maintenance organization (HMO): This type of plan uses a network, and you’re required to have a PCP.

- Preferred provider organization (PPO): You can get care from anyone with this plan, and you often don’t need to see a PCP first. But you’ll pay less if you work with doctors in the network.

- Medicare: This is federal health insurance for the disabled and people 65 and older. You have to work in the United States in a qualified job for a while before you can enroll.

- Medicaid: This form of health insurance is for low-income individuals. It’s funded at the state and federal level. Every state has different enrollment criteria.

- Health insurance marketplace: Americans often have health insurance through their employers. If you don’t, you can use this platform to enroll in insurance. In some parts of the country, the platform is run by the states. In others, it’s run by the government.

- Open enrollment: These are the time periods when you can sign up. They’re common for Medicare, workplace insurance, and marketplace plans.

- Qualifying event: A big life issue, such as changing jobs or moving, could help you skip open enrollment and get covered.

How to Find Insurance

Now that you understand the terminology insurance companies use, you can be a smart shopper for yourself and your family.

Every American should have a health insurance plan, and most do. According to the

You can start your search by:

- Asking your employer. More than half of all Americans get insurance through their jobs, researchers say. If you work fulltime for a large company, your benefits should include health insurance. If you only work part-time or the company you work for is very small, that may not be true. But if you can get insurance through work, it’s a good option. Some of your costs will be covered by your company.

- Asking your caseworker. Did a government official get assigned to help you make the switch from your country to this one? Ask about enrollment in Medicaid, either for you or your family. You might be eligible for benefits.

- Researching the marketplace. If you don’t have insurance through work and you’re not eligible for Medicaid, you can still get coverage. Visit the government website, type in the state you’re living in, and you’ll head to an enrollment page.

- Contacting insurance companies. Many organizations offer care through the marketplace, but not all of them do. If your friends or family members have plans they like, the organization could offer individual plans for people just like you. They could be cheaper or more expensive than those in the marketplace.

No matter how you get coverage, you’ll have decisions to make. Think about:

- Your finances. You’ll have to pay your premium on time to keep your coverage. The plan that looks wonderful to you could come with a monthly price tag you can’t afford.

- Your health. Do you have plenty of health conditions that need treatment? You’ll probably want a plan with generous coverage and low deductibles. Are you young and relatively healthy? A cheaper policy with a big deductible might be better for you.

- Your lifestyle. Do your sports or hobbies put you at risk for sudden illnesses, like broken bones? You’ll need a plan that helps to cover those expenses without breaking the bank.

- Your location. If your plan requires a network, can you find doctors near you that are covered? An insurance package is worthless if you can’t use it.

It’s a big decision, and it’s fine if you need to take time and consider all your options before you announce your final selection. Once you make a choice, you can’t change it until the next open enrollment period, so it pays to be careful.

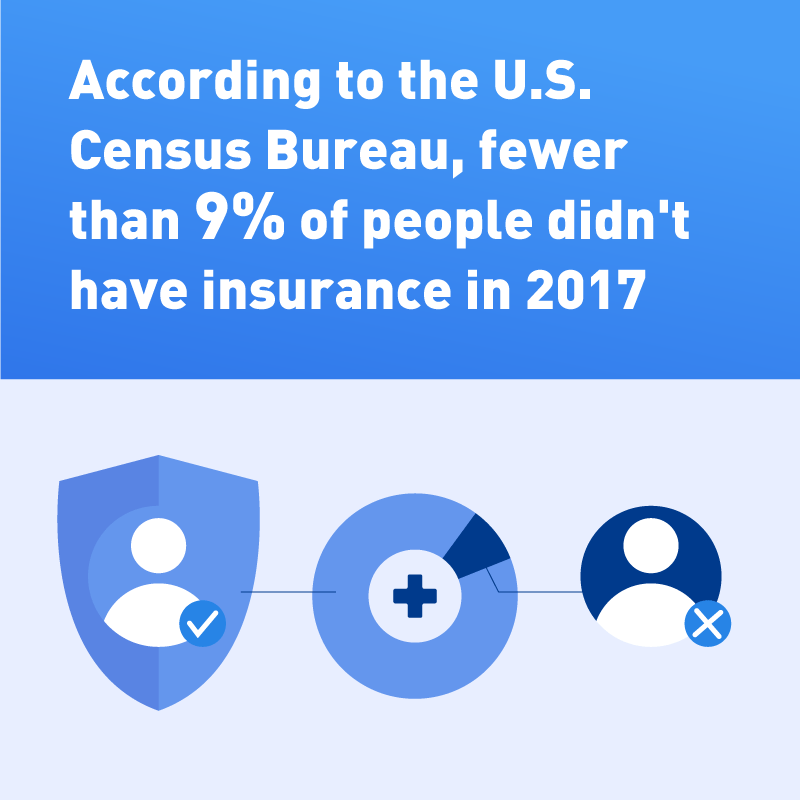

How to Find a Doctor

Typically, you’ll want to work with a professional who specializes in primary care. The Agency for Healthcare Research and Quality says there are more than 209,000 of them in the United States, so you have plenty to choose from.

This doctor will:

- Ensure you get appropriate screening tests.

- Offer vaccines.

- Handle minor issues, including coughs and ear infections.

- Send you to specialists if something goes wrong.

- Tackle your follow-up care after a major illness or injury.

How can you find someone like this? Start by:

- Talking to your insurance company. Many plans will have a network of doctors you can choose from. A directory of these professionals might include names, locations, specialties, languages spoken, and other key bits of data you need to make a smart decision.

- Asking your friends. Reach out to people you trust and ask for their recommendations.

- Thinking about proximity. You’ll visit your doctor often. Choose someone you can visit easily. Perhaps the office is near your home or your workplace. Maybe the office is easy to access via bus or car.

You can switch primary care providers as often as you’d like to. But each time you do so, you’re starting over with a new professional who doesn’t know anything about you, your health history, or your preferences. If you can, take your time when choosing the first time.

Will You Need Vaccines?

A vaccination protects you from getting a communicable disease. Shots also keep the community safe, as they keep dangerous conditions from living in human hosts.

Since vaccines are so important, they’re tracked carefully by state and federal officials. You may be required to get shots before you enter the country, and if you didn’t, you’ll need to catch up on what you missed.

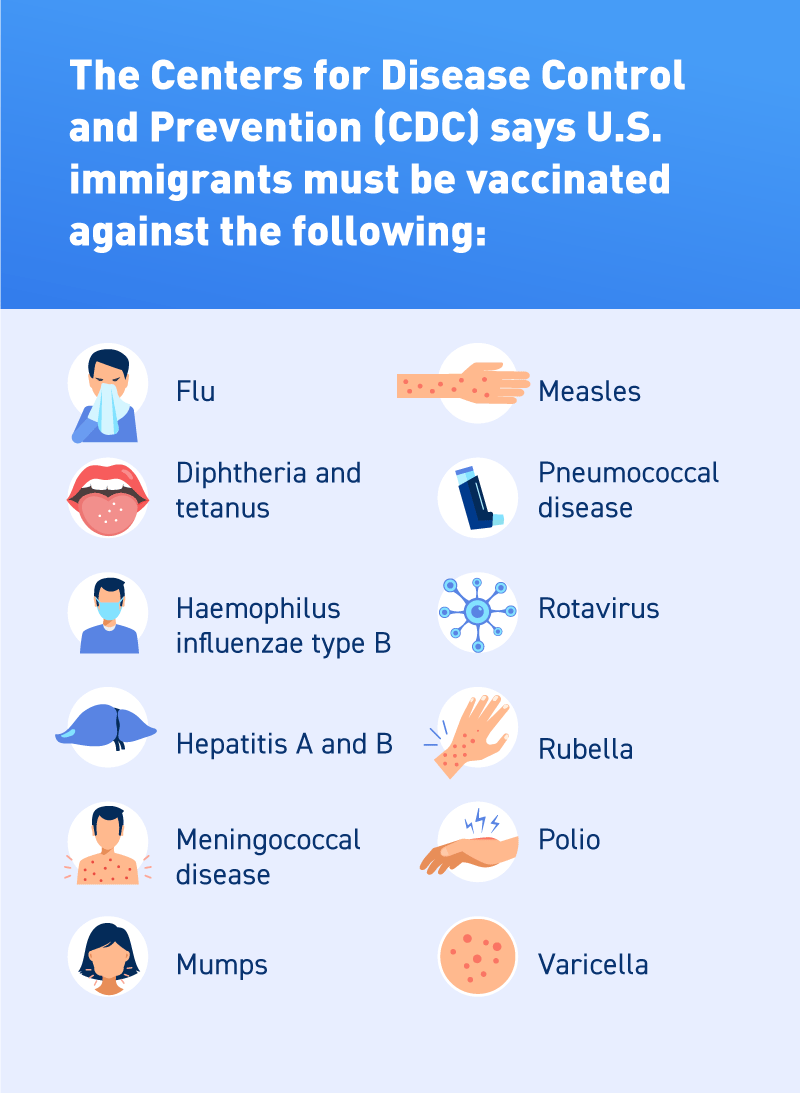

The Centers for Disease Control and Prevention (CDC) says U.S. immigrants must be vaccinated against the following:

- Flu

- Diphtheria and tetanus

- Haemophilus influenzae type B

- Hepatitis A and B

- Meningococcal disease

- Mumps

- Measles

- Pneumococcal disease

- Rotavirus

- Rubella

- Polio

- Varicella

The CDC also says that adults need vaccines to protect them from conditions they might get later in life. Those vaccines are different than those you need to enter the country. You’ll need a pertussis vaccine, for example, and your doctor might recommend shots to protect you from the human papilloma virus.

When you head to your first visit with your doctor, bring all your medical records with you. Proof of your vaccines, screening tests, and medical examinations are very helpful for your doctor. That way, it’s easy to tell what you’ve had and what you might be missing, so the right plan can be created just for you.

If you plan to visit your home country (or any other country), your doctor might recommend yet another set of vaccines to help you stay healthy during the trip. Your immunity changes with time. Even though you lived in your home country for decades, your body might be different now, and that could lead to disease vulnerability. Your doctor can help you prepare.

Will You Need Health Screenings?

Your primary care provider’s job is to keep you healthy for as long as possible. That work is called preventive care, and screenings play a huge role.

Health screenings help your doctor spot conditions when they’re new and easier to treat. They also help your doctor give guidance, so you’ll lower your risk of getting a disease in the future.

Preventive care focuses on the top killers of Americans, which researchers say includes the following:

- Heart disease

- Cancer

- Respiratory disease

- Stroke

- Diabetes

- Kidney disease

Your doctor can check your blood pressure, send blood samples to the laboratory to check your cholesterol and blood sugar, listen to your heart, and assess your weight. All these simple tests help your doctor spot problems that could worsen with time.

Women need even more tests, including mammograms and Pap tests. And if you’re older, your doctor might want to run a few more screenings to assess your health.

Typically, you’ll see your doctor every year for these checks and assessments. But if you have an underlying health issue, like diabetes, you might need to visit more frequently.

Understand Your Fees

When you use your insurance, the plan sends you an explanation of your benefits. That document typically outlines:

- Total fees. How much did the incident cost you?

- An insurance portion. How much did your insurance company pay?

- Deductible and coinsurance amounts. How much of the fee is your responsibility?

- The responsible party. You see something on this document that you don’t agree with. The company listed here can give you answers.

Many health insurance companies don’t charge you for preventive care. That means you might not have a bill for regular doctor visits, vaccines, or health screenings. But what happens when you have a different type of health problem?

Emergency room visits, surgeries, and other significant forms of medical care often come with big bills. And if you have a plan with a high deductible and a high out-of-pocket cap, you could have a lot to pay.

For some Americans, travel is the answer. Researchers report that more than 1.4 million Americans went to other countries for medical care. Their bills for surgeries and procedures in places like Costa Rica and India were smaller than the bills they’d have here — even with insurance.

Medical tourism, as this is called, could save you money. But remember to factor in fees related to travel and lodging. Sometimes, a deal that looks good on paper ends up costing you more in the long run.

If your bills are so high that you’re considering a plane trip to another country, talk with your doctor. Sometimes, you can use payment plans to cover the costs without ruining your budget.

Use Your Insurance Plan to Save Money

Reading about insurance and coverage in the United States can be depressing, especially if you come from a country where all of these expenses are covered by your taxes. But don’t get discouraged.

Health insurance can be expensive, but it can save you money. As researchers explain, medicine in America is expensive. A broken leg, for example, could cost you up to $7,500 to fix here. Without insurance, you could be responsible for that entire bill.

Health insurance protects you from the catastrophic costs associated with medical expenses. It’s coverage worth having.

If you do get sick and have a large bill, hospitals and clinics will expect you to pay it. If you don’t, they can send you to collections agencies that can garnish your wages, seize your assets, and more. Insurance protects you from all of that.

And if you’re looking for even more ways to save money on medical care, consider Save.health. We don’t offer insurance, but we can provide discounts on medications your doctor might use to treat illness.

Use these discounts instead of your insurance card, and you could save money at the pharmacy. There are no strings attached. Find out more about who we are and how it works here.

References

Mexico Achieves Universal Health Coverage, Enrolls 52.6 Million People in Less Than a Decade. (August 2012). Harvard T.H Chan School of Public Health.

4 Basic Health Insurance Terms 96% of Americans Don’t Understand. Policy Genius.

Glossary of Health Insurance Terms. Medical Mutual.

Common Health Insurance Terms and Definitions. Wisconsin Physicians Service Insurance Corporation.

Health Insurance Coverage in the United States: 2017. (September 2018). United States Census Bureau.

Coverage at Work: The Share of Nonelderly Americans with Employer-Based Insurance Rose Modestly in Recent Years, But Has Declined Markedly Over the Long Term. (February 2019). The Henry J. Kaiser Family Foundation.

The Number of Practicing Primary Care Physicians in the United States. (July 2018). Agency for Healthcare Research and Quality.

New Vaccination Criteria for U.S. Immigration. (March 2012). Centers for Disease Control and Prevention.

Medical Examination of Immigrants and Refugees. (March 2012). Centers for Disease Control and Prevention.

Vaccines for Immigrants and Refugees. (March 2019). Centers for Disease Control and Prevention.

Attention Adults: You Need Vaccines Too! (February 2019). Centers for Disease Control and Prevention.

Mortality in the United States, 2017. (November 2018). Centers for Disease Control and Prevention.

Medical Tourists: Incoming and Outgoing. (2018). The American Journal of Medicine.

Why Health Insurance Is Important: Protection From High Medical Costs. U.S. Centers for Medicare and Medicaid Services.